Nj Sports Gambling Tax

- Being that each state taxes sports betting at a different rate, a higher betting handle doesn’t always equate to more money for the state.

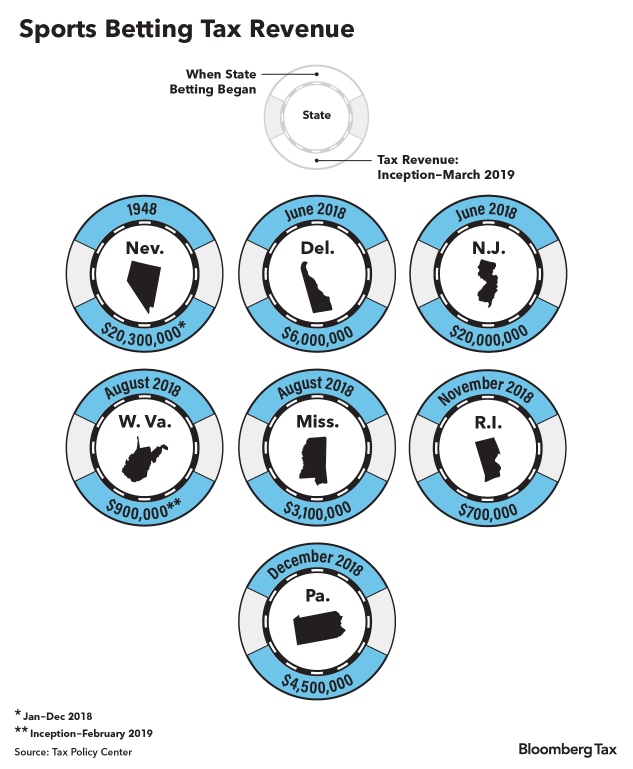

- New Jersey has collected the most sports betting tax revenue through 2019; however, Pennsylvania could surpass them with their recent mobile betting expansion.

- The majority of states allocate the taxes revenue to the state’s general fund to help with educational programs, health services, or infrastructure repair.

TALLAHASSEE, Fla. – Since the sports betting ban in the United States was lifted in May of last year, over $66 million in tax revenue has been contributed to state and city governments.

The expanded gambling primarily benefits the state government in the capital city of Trenton – not Atlantic City. In fact, of the 13 percent tax on mobile sports betting win, and 8.5 percent on. All gambling winnings are taxable under the Internal Revenue Code. Winnings from playing online in New Jersey for U.S. Residents are no different than from playing online in Nevada or Delaware, or from playing in brick and mortar casinos throughout the United States. NJ Lawmakers Push Back On ‘Integrity Fee’ For Sports Betting, Set Taxes For Bets At Tracks, Casinos And Online June 4, 2018 at 5:37 pm Filed Under: Local TV, Meg Baker, New Jersey, Sports. Sports Betting in AC. According to a November 12 article on www.pressofatlanticcity.com, over the course of not quite a year and a half, NJ sportsbooks have taken in over $3 billion in legal wagers, generating $284.6 million in gaming revenue and over $36 million in taxes.

However, the legal states do not equally split this revenue, as each state is programmed with the responsibility to tax and regulate their own sports betting market as they see fit.

Federal laws prevent sportsbooks from accepting action across state lines, which play a vital role in ensuring each state is correctly represented without the fear of being overtaken by a major sportsbook elsewhere in the country.

Since the year began, with seven sports betting states reporting (New Mexico excluded), the tax contributions for both the states and cities have exceeded $34 million.

Which States Bring In The Most Sports Betting Tax Revenue?

New Jersey – 8% (land-based), 13% (online)

New Jersey has quickly emerged as the second most favorable place for Americans to wager on sports. To the surprise of many, New Jersey sportsbooks have contributed the most sports betting tax revenue to their state for all of 2019 ($13.3 million) – even more than Nevada.

Responsible for 38.6% of all tax revenue in 2019, New Jersey’s funds get allocated to the Casino Revenue Fund, which gets split into a variety of coffers. The Department of Human Services is the largest beneficiary of the revenue, which receives the money to support programs for the elderly and disabled. If contributed from a racetrack, the cities which host the book also receives a small portion of the contributions.

Nevada – 6.75% to state

Despite posting the lowest percentage of book revenue contributed to its state, Nevada is responsible for nearly a quarter of the total for the year. This makes sense, as the state has driven the market for the past few decades and the average betting handle per month is well above $400 million.

Their $7.8 million collected has gone directly to the state’s general fund for the use of financing state programs. Education and health services are the key recipients of the money and Nevada has been associating gaming revenue towards these fields for some years now.

Pennsylvania – 34% to state, 2% to counties

With $6.9 million in tax contributions since the start of the year, Pennsylvania is primed to jump both Nevada and New Jersey moving forward. They have the largest tax rate of the large market states (NV, NJ, PA, MS) and with their recent addition of mobile betting, their handle is guaranteed to increase throughout the second half of the year.

The 36% tax rate gets broken up with all but 2% of it going to the state government’s general fund. There is no real way to determine what the money gets spent on but it has been said to fund essential programs and work as a rainy-day fund. The remaining 2% heads to the counties and is used for a variety of infrastructure and other projects.

Delaware – 50% to state

Because the Delaware Lottery operates the industry, the state is able to tax sports betting at an astounding 50%! With only three operational sportsbooks in Delaware (the three racetracks of the state), there are fewer operators and suppliers required to be paid out.

Totaling $2.1 million in sports betting tax revenue on the year, the taxes collected get attributed to the general fund. Infrastructure and essential childhood programs are believed to be the benefactor of the money; however, like Pennsylvania, there is no real way to see the flow of cash. Additionally, the tax money is used to increase the purse sizes at the three state-licensed horse racing tracks.

Rhode Island – 51% to state

With over $100 million in action wagered this year alone in Rhode Island, the state could be benefiting much greater than they are with their 51% tax on sports betting. Bettors in Rhode Island have continually proven to be the best of the legal sports betting states, keeping revenue (and tax contributions) lower than anticipated.

Since the beginning of the year, the state’s general fund has collected nearly $1.9 million in taxes from sports betting. Transportation issues, such as bridge and road repairs as well as education programs helping at-risk youths are said to be where the funds are headed.

Mississippi – 8% to state, 4% to cities

Nj Sports Gambling Tax Advice

Mississippi has the third-largest casino market in the country behind Las Vegas and Atlantic City but without mobile betting, they have been falling behind in the revenue department. Mississippi bettors have struggled against the books, but with only 12% removed for tax purposes, they fall second-to-last in the year-to-date tax contributions.

Over $1.7 million has been collected from the near-$145 million YTD betting handle, with the state government receiving $1.1 million and the remaining heading to the cities where the sportsbooks are located. Mississippi has a broad idea of what the money can be used for, as the Department of Revenue determines which funds to allocate the money toward. Whether being used by the state or city for planned or emergency reasons, the money helps repair roads, sewer systems, and other infrastructure projects in their district.

West Virginia – 8.5% to state

A snafu in the Mountaineer State concerning two of their five licensed sportsbooks has limited the production of sports betting in West Virginia. Only $504,426 has been collected by the state throughout the first ten months of operation, which will be dedicated to the general fund when legislators determine a need for it. According to the bill that legalized sports betting in WV, it will be deposited in the Public Employees Insurance Agency Financial Stability Fund.

However, the state regulations require the first $15 million collected to be allocated to the Sports Wagering Fund, which is an interest-bearing account. This money is to be used for the costs of operating sports wagering from administrative expenses to oversight of the regulations.

Nj Online Sports Betting Tax

News tags: Delaware Mississippi Nevada New Jersey Pennsylvania Rhode Island West Virginia

Nj Sports Gambling Tax Rules

Michael began writing as an NBA content writer and has spent time scouting college basketball for Florida State University under Leonard Hamilton and the University of Alabama under Anthony Grant. A graduate of both schools, he covers topics focused on legal sports betting, betting odds, and casino reviews. Michael likes to golf, play basketball, hike, and kayak when not glued to the TV watching NBA games.